What Can I Do with SouthState’s Treasury Navigator® Mobile App?

11/22/2022

Are you looking for a versatile, intuitive, and secure method to streamline daily financial operations?

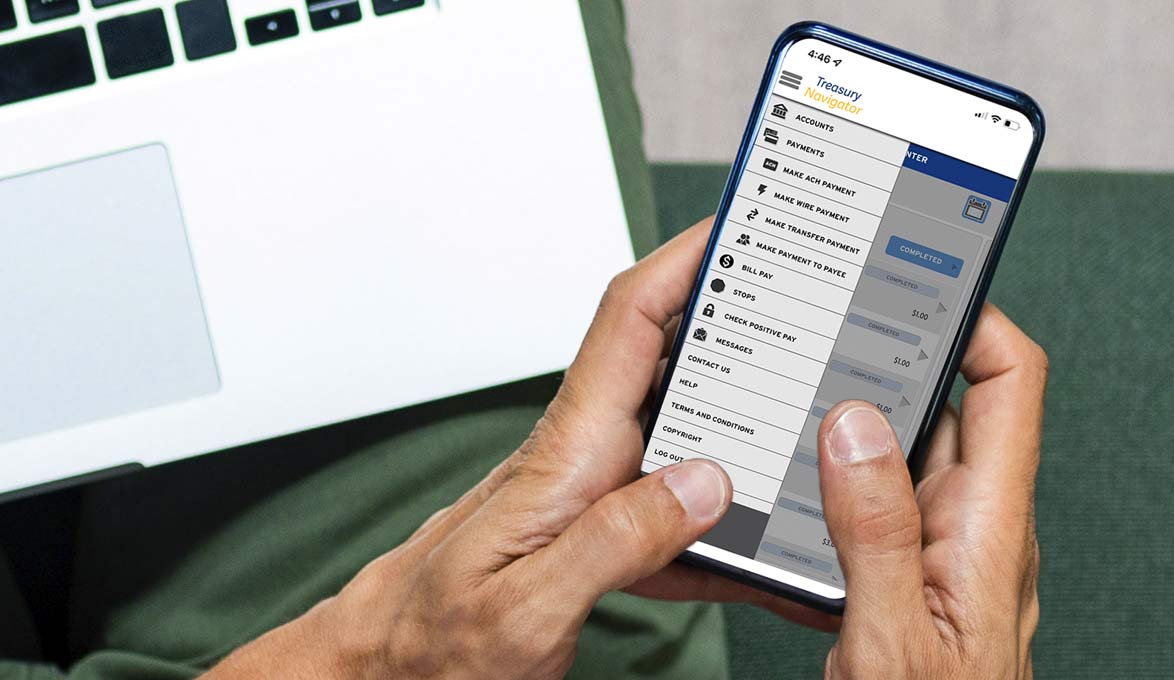

Our Treasury Navigator® system is a robust platform designed to make cash management fast, easy, and convenient – whether you’re in your office or on the go. Once you enroll in Treasury Navigator®, you can download and utilize the functionality and features of our online tool anywhere. While you have access to the full suite of tools in the desktop platform, the mobile app offers many of the same key benefits. Here are 9 ways the Treasury Navigator® mobile app can simplify your cash management today.1Mobile Deposit

Sometimes there aren’t enough hours in the day to run your company and get to the bank on time. With mobile deposit, you can use your smartphone’s camera to deposit checks anytime, anywhere. Make sure to take a clear picture and properly endorse the back of the check. Then snap, submit, and get back to business.Enter Stop Payments

Finances can go awry quickly when invalid checks are processed. There are instances when you may want to consider placing a Stop Payment, including if a check is lost or stolen, or there is a dispute between you and the payee. Simply open your mobile app and enter in the check information for the item you’d wish to withhold payment. The stop will be placed – keeping your accounts in order and giving you peace of mind.Bill Pay

Writing, stamping, and mailing checks are a thing of the past. Use your mobile app to schedule timely payments or to securely approve a payment entered by another user. If you’d like to create a new payee, you or another authorized user will need to log on to the desktop version. However, after the payee has been created, you can make payments (to that payee) from the mobile app time and time again.Automatic Clearing House (ACH)

ACH is a secure electronic payment method designed for bank-to-bank payments, and is typically used for transactions like payroll, direct deposits, and recurring debits. Like the Bill Pay feature, you or another authorized user will need to log on to the desktop platform if you want to create a new payee. However, after the payee has been created, a template will be saved, allowing you to initiate payments (to that payee) from the mobile app in the future.Wires

Wire transfers are a real-time payment solution used to deliver funds either domestically or internationally. With the Treasury Navigator® mobile app, you’re able to enter a wire using an existing repetitive template, or approve a wire entered by another user. It’s important to note only United States dollar wires can be initiated through the mobile app.Check Positive Pay

Positive Pay is an additional form of security Treasury Navigator® offers to protect your company against forged, altered, and counterfeit checks. This automated service minimizes the potential of fraudulent activity and ensures only valid, client-issued checks post to your accounts. If anything unusual is detected, you will be notified and can review activity, apply decisions, and enter any issues with your mobile app.View Transaction History

Reviewing your transaction history is important for both accuracy and security. Whether you’re checking your transactions for the day, reviewing last months payments, or researching a particular item, the Treasury Navigator® mobile app makes it easy to research transaction history on the go.View Paid Check and Deposit Images

Remember the check and deposit images you previously shoved in filing cabinets? You no longer have to rummage through stacks of paper to find what you’re looking for. Your mobile app houses check and deposit images so you can easily locate them when you need them.Complete Account Transfers

While account transfers are only processed during business banking hours, you and authorized employees can schedule internal account transfers 24 hours a day, 7 days a week. You have the control to set up current day and future- dated account transfers through the Treasury Navigator® mobile app.If you’re interested in learning how to use Treasury Navigator®, we have demos on our website to help you. Our knowledgeable Treasury Management experts are standing by to answer any questions you may have on Treasury Navigator® or any of our Treasury Management solutions.

Learn about how Treasury Navigator® can help protect your business from fraud.

About the Author, Marien Alicea-Morales: Marien is currently a Treasury Management Product Manager at SouthState. She has over 16 years’ experience in all aspects of Treasury Management including Customer Support, Product, and Sales.

1. Fees may apply. Contact your banker for details. Subject to credit approval.