Understanding the Five C’s of Credit

8/19/2022

As a business owner, you know there will likely come a time when you need additional financing to help your business reach the next level.

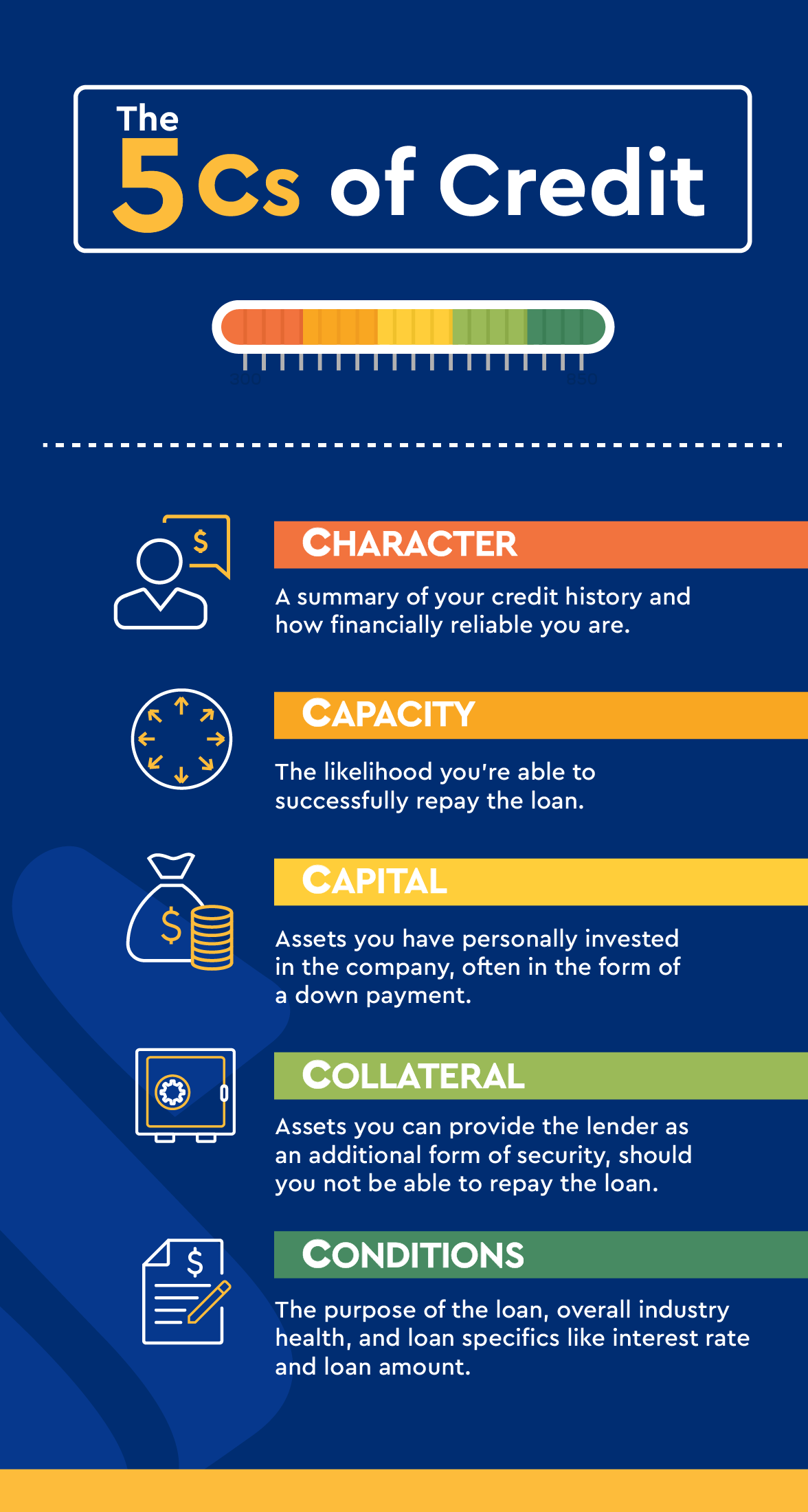

When you apply for a business loan, a lender is going to use the Five Cs of credit to evaluate your loan application, gauge your creditworthiness, and set your loan terms. This method helps lenders make sound decisions to prevent financial risk or loss. By knowing what characteristics lenders are assessing, you can set yourself up for success early on.In this article, you’ll become familiar with the “Five Cs of Credit” (character, capacity, capital, conditions, and collateral) to further understand what lenders are looking for when assessing your loan application.

Character

The first element in the list is character; in this case, ‘character’ means credit history. Before thoroughly assessing your credit report, a lender will likely glance at your credit score. This number can give lenders a strong indication of how financially reliable you and your company are. Your repayment history, credit utilization ratio, the business’ financial performance, and other information all help to make up this calculation.Every lender determines for themselves what is an acceptable credit score and how they will use a credit score within their loan approval process. While the minimum requirement may vary between lenders, the higher your credit score is, the better your chances are of being approved for financing. A higher credit score generally signifies less risk to the lender and can help you secure more favorable loan rates and terms.

Action items:

You can ensure your score is an accurate reflection of your financial reliability by regularly reviewing your credit report for accuracy. You don’t want an error on your report to be lowering your score. To keep your credit in top-notch condition, consider setting up recurring payments to ensure your future debts are paid on time. Paying monthly recurring payments on-time can help build a steady payment history, further improving your credit score.Capacity

Next is capacity, which measures the borrower’s ability to successfully repay the loan. This element helps determine risk exposure for the lender. Your income amount, debt-to-income (DTI) ratio, employment history, and current job stability are evaluated to determine the likelihood you can repay the loan.Your DTI ratio is calculated by adding all your monthly debt payments and dividing it by your gross monthly income. The maximum acceptable DTI ratio can vary between lenders; however, most prefer an applicant’s DTI to be around 35 percent or less.

Action items:

Your DTI ratio is the biggest element of capacity. Improving your salary could help lower your DTI ratio but be mindful lenders favor job and income stability. If you’re carrying excess debt, paying down balances will improve your capacity. Be wary of refinancing for lower interest rates or lower monthly payments as these options might cost more in the long run. Continue to make timely loan payments and manage your cash flow adequately to show lenders you have the means to successfully repay your loan.Capital

Capital represents the amount of personal assets the borrower invests into the success of the company. If a borrower has already committed their own assets to the loan they’re trying to secure, this shows lenders they’re willing to share financial risk. Additionally, investing personal capital decreases the chance of default and helps show the lender you’re serious about the loan. For example, if a borrower puts a down payment on a home, they might find it easier to obtain a mortgage.

Action items:

Work with your Certified Professional Accountant (CPA) to determine how much of your own capital is wise to invest in the company / loan. They can help you identify the assets necessary to keep your lending request reasonable.Collateral

Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan. Often collateral is the item you’re purchasing with the borrowed funds; for example, a car is collateral for an auto loan, a home is collateral for a mortgage, and equipment is collateral for equipment financing. This helps the lender feel more secure in the transaction because they will have something of value to possess if the borrower defaults on the loan.

Action items:

Items used for collateral can include real estate property, vehicles, receivables, cash, or even guarantors who will be responsible to pay your loan if you default. The riskier the loan you’re seeking, the higher value collateral the lender might require. It’s wise to work with your banker to assess how your collateral stacks up against your loan request.Conditions

In addition to examining credit history and income, lenders will also analyze the conditions of the loan. They will consider outside factors like how economic environment and industry trends can affect the success of your business, along with the purpose of the loan, the likelihood the business will succeed, and additional information like the loan amount, interest rate, etc. If you plan to use the money to generate future cash flow, you might have a better chance of receiving financing as opposed to using the loan for other purposes like renovations.

Action items:

Unfortunately, conditions are only partially controllable. Many conditions like the political climate, industry-specific legislation, or federal interest rates are not factors a borrower has control over. However, these conditions still help lenders assess the level of risk associated with the investment. As such, you should ensure your business plan accounts for adverse market conditions and includes a healthy cash flow forecast so lenders can have confidence in the future state of your company.Understanding the Five Cs of Credit can provide you with a North Star as you navigate business financing.

The lower the risk to the lender, the greater the chances you will get approved on favorable terms for the financing you need. Becoming familiar with the Five Cs can help you make sound business decisions on which type of financing and how much is reasonable to apply for. Securing capital for your business often requires risk on your end through collateral; talk to your accountant to assess how much risk you’re willing to take to receive the financing you’d like.About the Author, Justin Cho: Justin Cho serves as Credit Administrator for Government Lending at SouthState Bank. He has been with the bank for more than 5 years and was the first credit employee hired in the Small Business Administration (SBA) group. Cho is a proud recent graduate of the George Institute of Technology, where he received his Master of Business Administration degree.